Discover how assumable mortgages work, which loan types qualify, and the pros and cons of assuming a mortgage. Learn how this strategy could save you money in a high-rate market – and how Mortgage Broker Near Me can help you make it happen.

Apr 11, 2025

Buying a home can be tricky enough without worrying about rising interest rates. But what if there was a way to take over someone else's lower-rate mortgage? That’s where assumable mortgages come in. Let’s break it down in simple terms.

An assumable mortgage lets a homebuyer take over the seller’s existing mortgage — including the interest rate, loan balance, and terms. It’s like stepping into their shoes and picking up where they left off.

This can be a major win for buyers, especially if the seller locked in a low interest rate when the market was better.

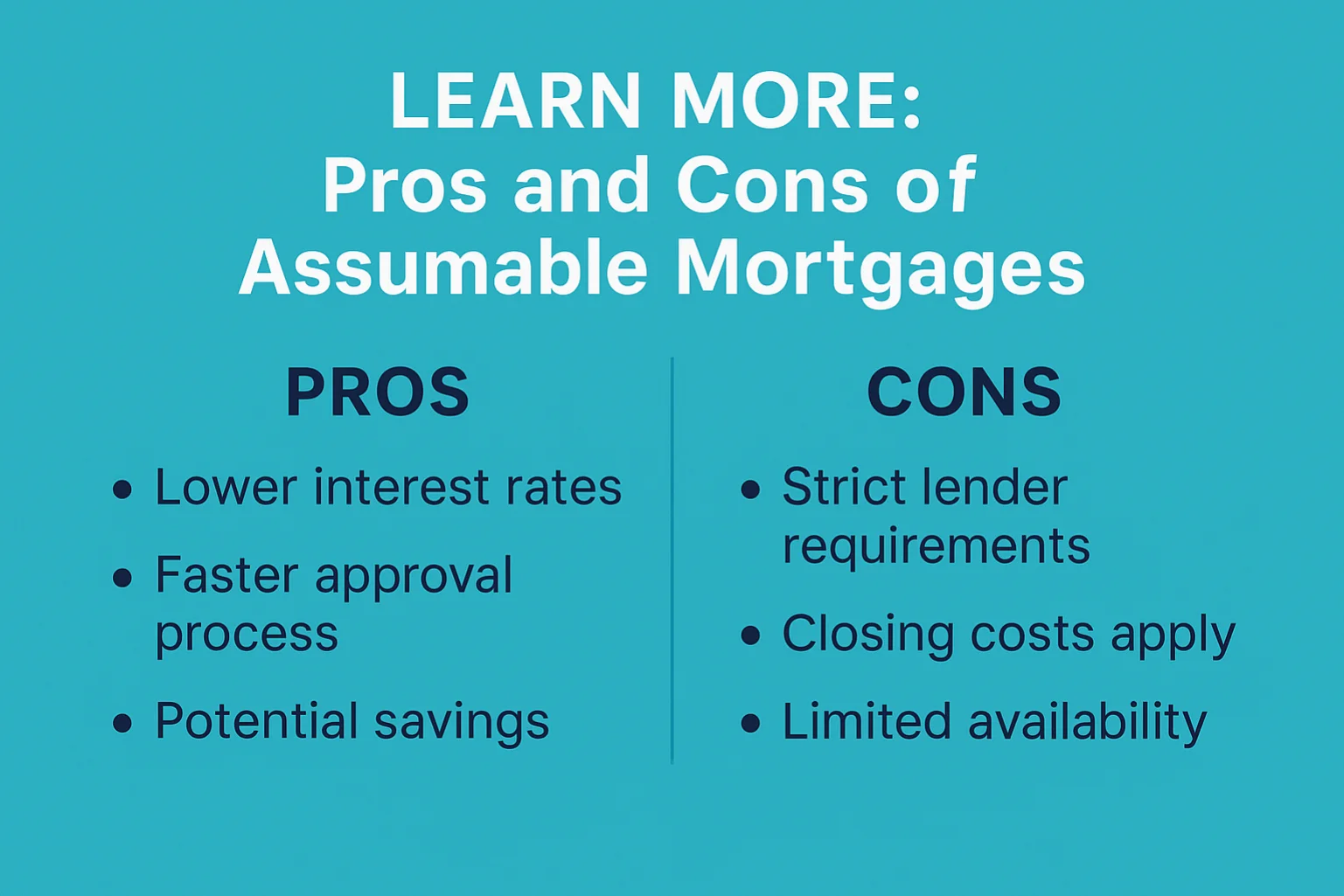

Not all loans are created equal. Here’s a quick look at which ones can be assumed:

“Comparison sites show you options. Mortgage brokers show you what’s right for you — based on your goals, not just the rates.”

In most cases, no. These usually come with a “due-on-sale” clause — meaning the mortgage must be paid in full when the home is sold. Some adjustable-rate mortgages (ARMs) might be assumable, but it’s rare and lender-specific.

Check the seller’s loan paperwork or ask their lender to confirm if the mortgage can be assumed.

Even if the loan is assumable, the buyer usually needs to qualify — similar to applying for a new loan.

You’ll need to pay the seller whatever equity they’ve built up in the home. For example, if the house is worth £300,000 and the mortgage has a balance of £200,000, you may need to cover the remaining £100,000 upfront or via a second loan.

After approval, sign the paperwork, pay any fees, and officially assume the mortgage.

Yes. In cases of death or divorce, mortgages can sometimes be assumed without going through the standard application. You may still need to cover equity and other legal steps.

Costs can vary, but typically include:

You need to meet the lender’s credit and income requirements, similar to a new mortgage.

Not in the traditional sense, but you’ll need to cover the seller’s equity somehow — either from savings or another loan.

Not always. If you assume an FHA loan, for example, you’ll still need to pay mortgage insurance.

They’re not super common, but they’re becoming more popular as interest rates stay high.

“A good mortgage broker doesn’t just find you a deal — they save you hours of paperwork, weeks of waiting, and thousands over the term.”

At Mortgage Broker Near Me, we help buyers and sellers navigate the complex world of home financing. Whether you’re looking to assume a mortgage or just want to explore your options, our expert advisors are here to make the process easier and clearer. We’ll:

Want to save thousands over the life of your loan? Start your journey with us today.

Assumable mortgages might not be the most common route, but in the right situation, they can be a smart way to save on interest and make a home more affordable. As always, work with a trusted mortgage broker to explore all your options and decide what’s right for you.

Need help finding or assuming a mortgage? Get in touch with our team at Mortgage Broker Near Me today.

Getting a mortgage right now feels harder because lenders keep changing their rules, but most of the barriers people face can be fixed. A “no” from one lender does not mean you cannot get a mortgage. Income rules vary, credit score rules vary, and each lender calculates affordability differently. A good broker checks everything upfront, matches you to the right lender, and fixes issues before they become problems. If you want to know what you can borrow without guessing, speak to MBNM.

Read Article

Explore whether it’s possible (or smart) to include your existing debts in a new mortgage. Learn what options are available to first-time buyers vs current homeowners, what lenders consider, and whether remortgaging for debt makes sense for you.

Read Article

A clear, beginner-friendly guide to the five main types of buy-to-let investments – Airbnb, HMO, AST, social housing, and student lets – with pros, cons, example costs, and tips to help you choose. Learn what each option involves and when to speak to a mortgage expert for tailored advice.

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.