Is It Cheaper to Use a Mortgage Broker? A Complete Guide for Homebuyers in Kent

Mar 18, 2025

Buying a home is one of the biggest financial commitments you'll make, and finding the right mortgage can be overwhelming. If you're wondering “Is it cheaper to use a mortgage broker?” or “Should I go through a bank or a broker?”, you're not alone.

At Mortgage Brokers Near Me, we provide expert mortgage advice in Kent and the Southeast, helping homebuyers and investors secure the best mortgage deals. In this guide, we’ll answer:

✅ Is it free to use a mortgage broker?

✅ What is a reasonable mortgage broker fee?

✅ Which bank is easiest to get a mortgage with in the UK?

✅ When should I speak to a mortgage broker?

✅ At what age should you pay off your mortgage?

Let’s dive in.

A mortgage broker is a financial expert who helps homebuyers and property investors find the best mortgage deal by:

Comparing lenders to find the lowest interest rates.

Handling paperwork to simplify the application process.

Providing independent advice tailored to your financial situation.

Securing better mortgage rates than those offered directly by banks.

Unlike banks, brokers aren’t tied to one lender, meaning they can find the most competitive deals for you.

Many homebuyers assume that going directly to a bank is cheaper, but in reality, a mortgage broker can save you money.

Access to exclusive deals – Some mortgage rates are only available through brokers.

Better mortgage rates – Brokers compare multiple lenders, ensuring you get the lowest interest rate.

Lower overall costs – Even if a broker charges a fee, the savings on interest rates often outweigh this cost.

💡 Tip: Some mortgage brokers, including Mortgage Brokers Near Me, offer free mortgage advice, meaning you don’t pay anything upfront.

The cost of a mortgage broker varies depending on the broker, lender, and mortgage complexity.

Fixed Broker Fee: £300 – £600

Percentage-Based Fee: 0.3% – 1% of the mortgage amount

Free Brokers: Some brokers earn a commission from lenders, making their service completely free to you.

At Mortgage Brokers Near Me, we offer free initial consultations, so you can explore your options without any commitment.

“A good mortgage broker doesn’t just find you a deal — they save you hours of paperwork, weeks of waiting, and thousands over the term.”

Some banks are more flexible than others when it comes to mortgage approvals.

🏦 Halifax – Ideal for first-time buyers and those with smaller deposits.

🏦 Barclays – Offers strong buy-to-let and first-time buyer mortgage options.

🏦 Nationwide – Good for remortgages and low deposit mortgages.

🏦 NatWest – Has mortgage advisors and flexible lending options.

🏦 HSBC – Competitive rates for professionals and high earners.

A mortgage broker can assess your financial situation and match you with the most suitable lender.

Yes! Many mortgage brokers provide free mortgage advice, meaning you won’t have to pay unless you proceed with a mortgage application.

Some brokers charge no fees because they receive commissions from lenders.

Others charge a small fee for complex cases, such as bad credit mortgages or self-employed applications.

Free consultations are often available, allowing you to explore your mortgage options at no cost.

If you’re unsure whether a broker charges a fee, always ask upfront.

Before house hunting – Knowing how much you can borrow helps narrow your property search.

Before remortgaging – Brokers can compare the best remortgage deals to save you money.

If you have bad credit – Brokers can find lenders that accept lower credit scores.

If you’re self-employed – Some lenders specialize in mortgages for freelancers and contractors.

Speaking to a broker early saves time, money, and stress when applying for a mortgage.

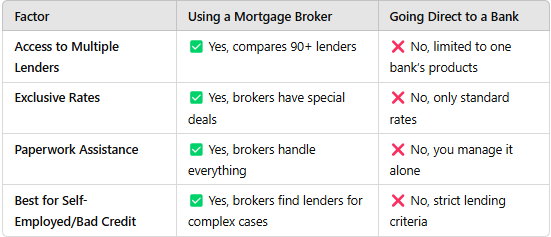

Many homebuyers ask, “Are brokers better than banks for mortgages?” Here’s a quick comparison above.

While banks may work for straightforward cases, a mortgage broker provides access to better rates, increased approval odds, and expert guidance.

Many homeowners aim to pay off their mortgage before retirement, but the right age depends on your financial goals.

✔ Being mortgage-free by 55 allows you to focus on retirement savings.

✔ Some choose to keep a mortgage for tax efficiency or investment purposes.

✔ Overpaying your mortgage can reduce interest costs and help you pay it off faster.

If you’re unsure whether being mortgage-free is the best option for you, a mortgage broker can provide tailored advice.

To secure the best mortgage deal, follow these steps:

Improve Your Credit Score – Higher scores lead to lower interest rates.

Increase Your Deposit – A bigger deposit reduces your loan-to-value (LTV) ratio, leading to better rates.

Compare Lenders – A mortgage broker can find the lowest available rates.

Consider Fixed Rates – Fixed-rate mortgages lock in a low interest rate for 2-5 years.

A mortgage broker will compare all available options to ensure you get the lowest mortgage rate possible.

“Comparison sites show you options. Mortgage brokers show you what’s right for you — based on your goals, not just the rates.”

If you’re looking for the best mortgage rates, expert advice, and a hassle-free process, using a mortgage broker in Kent is the best choice.

✔ Find the lowest interest rates

✔ Compare mortgages from 90+ lenders

✔ Get free, expert mortgage advice

✔ Increase your chances of approval

📞 Get in touch today and start your mortgage journey with confidence!

Is Using a Mortgage Broker Worth It? A Complete Guide for Homebuyers in Essex

Read Article

Should I Use a Mortgage Broker? A Complete Guide for Homebuyers in Milton Keynes

Read Article

Many homeowners are stuck on expensive rates or rejected for remortgages. Most of the time it’s not because they can’t afford it, but because they don’t know how lenders actually judge affordability in 2025. This guide breaks down the main reasons applications get blocked, and how a broker helps you get unstuck fast.

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.