Should I Use a Mortgage Broker? A Complete Guide for Homebuyers in Milton Keynes

Mar 18, 2025

Buying a home or remortgaging is one of the biggest financial decisions you’ll make. If you’re wondering “Should I use a mortgage broker?”, you’re not alone. Many people in Milton Keynes are unsure whether to go directly to a bank or work with a mortgage broker.

At Mortgage Brokers Near Me, we specialize in providing expert mortgage advice, helping homebuyers and homeowners find the best mortgage deals. This guide will cover:

✅ Which bank is easiest to get a mortgage with in the UK?

✅ Should I get a mortgage broker or do it myself?

✅ What is a red flag in a mortgage?

✅ Do lenders look at spending habits?

✅ How to get the lowest mortgage rate?

✅ Can I get free mortgage advice?

Let’s break it all down.

A mortgage broker is a financial expert who searches for the best mortgage deals on your behalf. Instead of applying to different banks yourself, a broker:

Searches the market to find the lowest interest rates.

Handles paperwork to streamline the mortgage process.

Provides expert advice tailored to your financial situation.

Helps you save money by finding the best mortgage rates.

Unlike banks, mortgage brokers aren’t tied to one lender, meaning they offer unbiased advice and access to a wider range of mortgage products.

“A good mortgage broker doesn’t just find you a deal — they save you hours of paperwork, weeks of waiting, and thousands over the term.”

Some banks are known for easier mortgage approvals, especially for first-time buyers or self-employed applicants. Here are a few top choices:

🏦 Halifax – Great for first-time buyers and offers flexible lending criteria.

🏦 Barclays – Strong buy-to-let and first-time buyer mortgage options.

🏦 Nationwide – Known for low deposit mortgages and great remortgage deals.

🏦 HSBC – Offers competitive mortgage rates for professionals and high earners.

🏦 NatWest – Has mortgage advisors and flexible options for various income levels.

Each bank has different lending criteria, so working with a mortgage broker can help match you to the best lender for your financial profile.

Yes! Lenders analyze your bank statements to assess:

Regular monthly expenses – Bills, rent, subscriptions, and discretionary spending.

Savings habits – Having money saved shows financial responsibility.

High-risk spending – Gambling transactions or excessive shopping may raise red flags.

Large unexplained transactions – Lenders want a clear picture of your financial situation.

💡 Tip: Before applying, review your bank statements for the last 6 months and reduce unnecessary spending.

If your mortgage payments feel too high, here are ways to reduce them:

Remortgage – Switch to a lower interest rate.

Increase Your Deposit – A larger deposit reduces monthly payments.

Extend Your Mortgage Term – Spreading payments over 30+ years can lower monthly costs.

Pay Off Other Debts – Reducing your debt-to-income ratio can help qualify for lower rates.

A mortgage broker can help find the best refinancing options to cut your monthly payments.

Securing the lowest mortgage rate can save you thousands over the term of your loan. Here’s how to get the best deal:

🔹 Improve Your Credit Score – Higher scores get lower rates.

🔹 Increase Your Deposit – A bigger deposit means lower interest rates.

🔹 Compare Lenders – Banks only offer their own rates, while brokers compare 90+ lenders.

🔹 Opt for a Fixed Rate Mortgage – Locks in a low rate for 2-5 years.

🔹 Reduce Your Debt-to-Income Ratio – Pay down credit cards and loans before applying.

A mortgage broker will find the lowest rate based on your situation, ensuring you don’t overpay on interest.

“I have no debt” – If you have credit cards or loans, be upfront about them.

"just changed jobs” – Lenders prefer stable employment before approving a mortgage.

“I can afford more than my budget” – Banks assess affordability based on income, not personal estimates.

“I’m planning a big purchase soon” – Large expenses before your mortgage approval can reduce your borrowing power.

Being honest about your financial history helps brokers find the best mortgage deal for you.

Yes! Many mortgage brokers, including Mortgage Brokers Near Me, offer free, no-obligation mortgage advice. Some brokers earn commission from lenders, meaning their service is free to you.

✅ Independent mortgage advice tailored to your needs.

✅ Expert guidance without hidden fees.

✅ Access to better rates than banks offer directly.

If you’re looking for free mortgage advice in Milton Keynes, contact us today to explore your options.

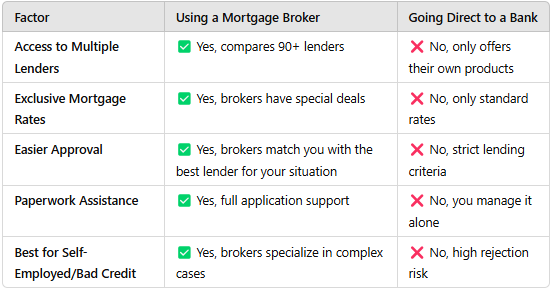

Many buyers ask, “Should I use a mortgage broker or go directly to a bank?” Here’s a quick comparison below.

Using a mortgage broker gives you access to better mortgage rates, easier approval, and professional support—all at no extra cost in many cases.

“Comparison sites show you options. Mortgage brokers show you what’s right for you — based on your goals, not just the rates.”

If you want the best mortgage rates, expert advice, and an easy application process, using a mortgage broker in Milton Keynes is the right choice.

✔ Find the lowest interest rates

✔ Compare mortgages from 90+ lenders

✔ Get free, expert mortgage advice

✔ Increase your chances of approval

📞 Get in touch today and start your mortgage journey with confidence!

If you’re buying your council home through Right to Buy, the discount can sometimes act like your deposit, which means you might not need to save a big cash deposit. But “no deposit” does not mean “guaranteed”. Lenders still check affordability, credit history, the property type, and whether the valuation stacks up. The fastest way to avoid getting messed about is to get the numbers checked properly before you apply, because the wrong lender or the wrong application order can cost you months. Your home may be repossessed if you do not keep up repayments on your mortgage.

Read ArticleWith interest rates shifting and remortgage deals changing weekly, choosing between a fixed or tracker mortgage in 2025 isn’t just about the numbers, it’s about what fits your goals, budget, and risk tolerance. In this guide, we break down the pros and cons of both options, share real examples from clients we've helped, and give you the insight you need to make the right move this year.

Read Article

Is Using a Mortgage Broker Worth It? A Complete Guide for Homebuyers in Essex

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.