Considering a remortgage in 2025? This guide breaks down fixed vs tracker mortgages in plain English - with real examples, expert advice, and a clear path to choosing the right deal for your situation.

Jun 30, 2025

When it comes to getting a mortgage in 2025, most people are asking:

“Should I go direct to a bank or use a mortgage broker?”

And more importantly:

“Which one will actually get me the best deal?”

In this guide, we’ll break it down simply. Just real answers from years of experience helping people like you at Mortgage Brokers Near Me.

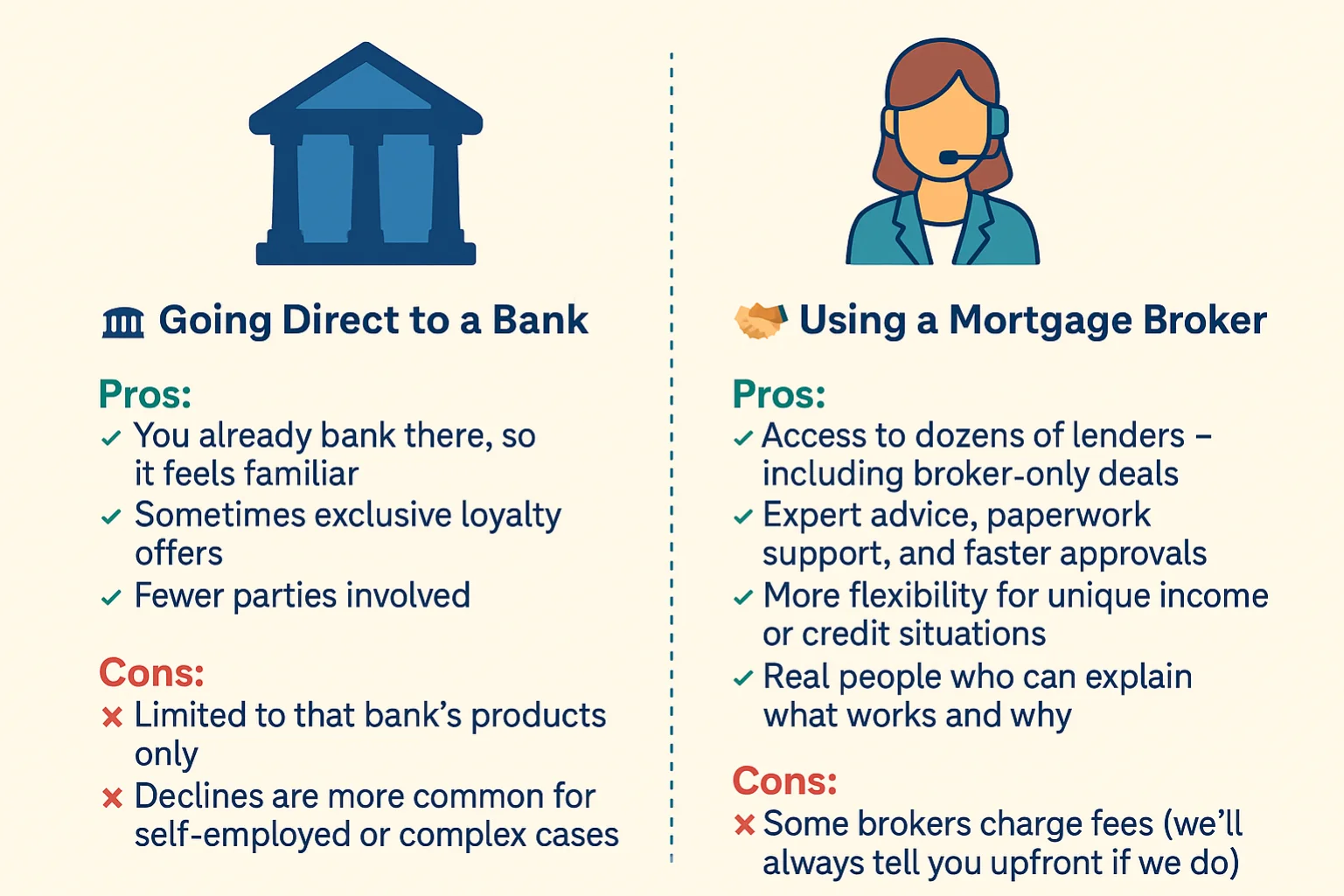

A bank offers you mortgage products from their own internal range. That means:

A broker works across many lenders to find the best deal for your situation. Brokers:

→ Use a broker. Most banks have strict criteria and may reject applications that don’t fit a perfect mould. Brokers know which lenders are flexible.

→ Use a broker. They can access specialist lenders with better 90–95% LTV options.

→ Try your bank too. It’s worth checking what they can offer just don’t stop there.

→ Go broker. Banks sell their own deals. Brokers give tailored guidance based on your goals, not just their product list.

"We speak to clients every week who’ve gone straight to their bank, been declined, and didn’t realise there were better options out there. A broker’s job isn’t to sell it’s to guide you to what actually works for your situation."

Not always. Some are free (paid by the lender), while others charge a fee.

But often, brokers can still save you more money than you'd pay in fees.

✅ At Mortgage Brokers Near Me, we’ll tell you upfront if it’s worth it or not.

Banks = more admin on you.

Brokers = one conversation → 30+ lender comparisons handled for you.

Banks = 1 lender’s deals

Brokers = 30–100+ lenders, including broker-only products

Tom came to us after being declined by his bank due to inconsistent income.

We matched him with a specialist lender who approved his mortgage at 85% LTV with a competitive fixed rate saving him the stress of applying again and risking his credit score.

Emily had a 5% deposit and was told by her bank that she’d need to wait longer.

We secured her a mortgage with a broker-only lender who accepted her on the same day not

A: Often, yes. They can access exclusive or specialist rates that banks don’t offer direct.

A: Yes. UK mortgage brokers are regulated by the FCA and legally must act in your best interest.

A: Not always. Many are free, or their fee is offset by a better deal. We’ll tell you upfront.

A: Absolutely. It’s one of the most common reasons people come to us.

At Mortgage Brokers Near Me, we:

Will Sharman has over 10 years of experience helping buyers, self-employed clients, and remortgagers find the right deal even in complex or urgent situations.

"I thought my bank would give me the best deal because I’ve been with them for years but Will found me a better rate with another lender and handled everything start to finish."

Whether you’re comparing deals, remortgaging, or buying your first home we’ll help you find out what you really qualify for, not just what a bank tells you.

Book a free call now with Will or one of our brokers we’ll do the legwork, show you your best options, and help you move forward with confidence.

If you have multiple income streams, recent changes to your accounts, or you have been told your income is “too complex”, you can still get a mortgage. The key is how your income is evidenced, explained, and presented to the right lender. In this guide, we break down how lenders assess complex income, what documents you will need, when cases get declined, and how we helped a self-employed buyer secure a full mortgage offer in time to keep their property chain together.

Read Article

Buying a flat? Learn why lease length, ground rent and service charges are crucial, how they affect mortgages and resale, and how Mortgage Brokers Near Me can help you buy with confidence.

Read Article

Ground rents are being capped at £250 a year, but the change is not immediate and it does not automatically fix mortgage issues for leaseholders. This guide explains what ground rent is, what the new cap actually means, when it comes into force, and how lenders assess leasehold properties today. Written to help buyers and existing leaseholders avoid costly mistakes when selling, buying, or remortgaging a leasehold home.

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.