A clear, step-by-step guide to the first-time buyer process, written by Will Sharman of Mortgage Brokers Near Me. Learn what happens at each stage and when to get expert help.

Aug 11, 2025

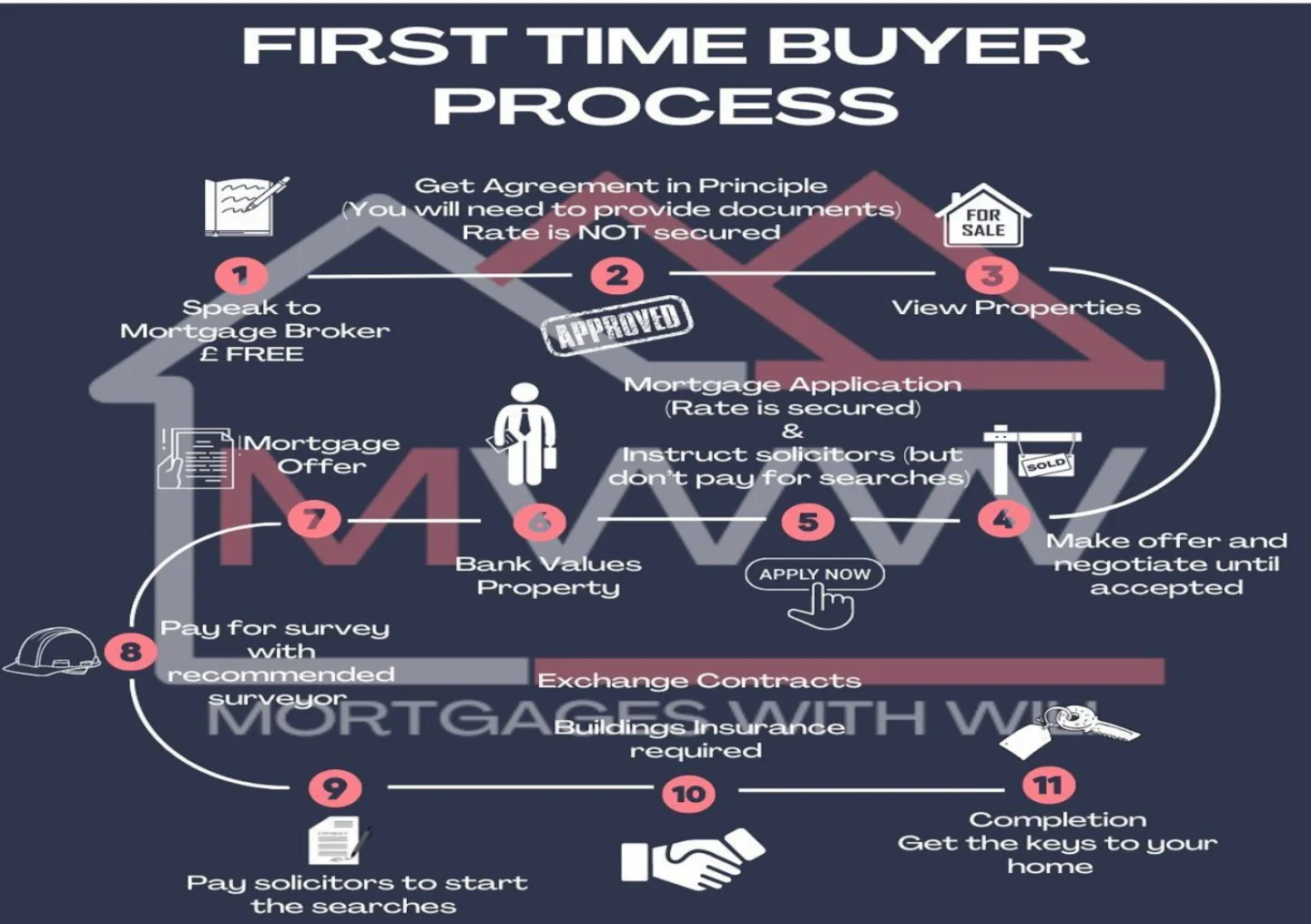

Buying your first home is exciting, but it can also feel overwhelming if you’ve never done it before. At Mortgage Brokers Near Me, we’ve helped countless first-time buyers navigate the process smoothly. This guide breaks it all down into simple steps so you know exactly what to expect — and when to get expert help.

Before you start viewing properties, it’s essential to know what you can realistically afford. Speaking to a mortgage broker (like us) is free for standard residential cases and gives you a clear idea of your borrowing power. We’ll check your finances, run through your options, and save you time by comparing deals from across the market.

An Agreement in Principle (AIP) is a statement from a lender showing how much they’re likely to lend you based on your circumstances. You’ll need to provide some documents, but remember this isn’t a guaranteed mortgage offer and the rate isn’t secured at this stage. It’s mainly to show sellers you’re a serious buyer.

Buying your first home doesn’t have to feel overwhelming with the right guidance, each step becomes clear and manageable." – Will Sharman

Now the fun begins. Start viewing properties within your budget. Take notes, ask questions, and try not to get carried away it’s easy to overlook issues when you’ve fallen in love with a place. We often advise clients on what to watch out for when viewing, especially if it might affect your mortgage.

When you’ve found ‘the one,’ make your offer. Be prepared for some back and forth before it’s accepted. Remember, the estate agent works for the seller, so don’t feel pressured into rushing.

Free First-Time Buyer Guide: Download our free step-by-step guide to buying your first home, packed with tips and insider advice from experienced mortgage brokers. [Get Your Free Guide Here].

Once your offer is accepted, it’s time to submit your full mortgage application. This is when your interest rate is secured. You’ll also need to instruct a solicitor or conveyancer to handle the legal side but hold off paying for searches until your mortgage valuation is complete.

The lender will arrange a valuation to make sure the property is worth the agreed price. This is for the bank’s benefit, not yours, so it’s still worth getting your own survey later.

If everything checks out, you’ll receive a formal mortgage offer. This is your green light to move forward.

We always recommend getting a survey done so you know about any structural issues before committing. A surveyor will give you a detailed report on the property’s condition.

Once the survey results are in and you’re happy to proceed, your solicitor can start the searches checking things like planning permissions, flood risk, and local authority details.

This is when the deal becomes legally binding. You’ll also need to have buildings insurance in place from this point, as you’re now responsible for the property.

On completion day, the funds are transferred, and you finally get the keys to your new home. Time to move in and celebrate.

With years of experience helping first-time buyers, we know how to guide you through every stage of the process, avoiding delays and costly mistakes. From finding the right mortgage to liaising with solicitors and estate agents, we’re with you from start to finish.

Do I need an AIP before viewing houses?

It’s not a legal requirement, but it helps estate agents take you seriously.

How long does the whole process take?

On average, 8–12 weeks from offer to completion, but it can vary.

Can I use my own solicitor?

Yes and in many cases, it’s better to choose your own rather than one recommended by the estate agent.

What if the bank’s valuation is lower than my offer?

You may need to renegotiate the price or increase your deposit.

The earlier you speak to a mortgage broker, the smoother your home-buying journey will be." – Will Sharman

If you’re thinking about buying your first home, our team at Mortgage Brokers Near Me can help you every step of the way. We’ll find you the right mortgage, explain the process in plain English, and make sure you avoid common pitfalls.

Want to be fully prepared before you start? Grab our Free First-Time Buyer Guide and learn exactly what to expect at every stage of the process.

Get in touch today for free first-time buyer advice.

If you own less than 25% of a limited company, many UK mortgage lenders won’t class you as self-employed. That means your income may be assessed like a standard PAYE employee using payslips and a P60, not two years of company accounts. In the right circumstances, this can unlock earlier mortgage approval, more lender choice, and better rates. A real MBNM case study below shows how a 1% difference in shareholding made all the difference.

Read Article

The best time to get life insurance is as early as possible, when premiums are lower and health checks are easier to pass. Major life events like buying a home, marriage, or having children make cover even more important. Life insurance ensures your mortgage and family are financially protected if something happens to you.

Read Article

Is It Cheaper to Use a Mortgage Broker in Manchester?

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.