Can I get a joint mortgage with an IVA? Yes – but it depends on the IVA’s status, your deposit size, and your partner’s credit profile. This guide from Will Sharman at Mortgage Brokers Near Me explains how joint mortgages work with an IVA, which lenders might accept you, and what to expect during the process. Includes FAQs, real-life examples, and expert tips to boost your approval chances.

Jul 7, 2025

A joint mortgage is when two or more people apply for a mortgage together – often partners, family members, or friends. But if one person has a financial history that includes an IVA (Individual Voluntary Arrangement), it’s natural to wonder if you’ll still be eligible to get approved.

Good news: Yes, it is possible to get a joint mortgage if one of you has an IVA – but it’s more complex than a standard application. Let’s break it all down.

An IVA is a formal debt solution that helps people pay back a portion of what they owe through affordable monthly payments. It usually lasts five to six years, and stays on your credit file for six years from the date it begins.

Because it’s listed on your credit history, mortgage lenders see it as a red flag – but that doesn’t mean automatic rejection.

“With more than 75,000 IVAs approved in the UK last year, we’re seeing a steady rise in joint mortgage enquiries where one partner has an IVA. Lenders are adapting but deposit size and timing still matter.” — Will Sharman,

Yes, you can – but the lender will look at both applicants’ credit profiles, and usually base their decision on the weaker of the two.

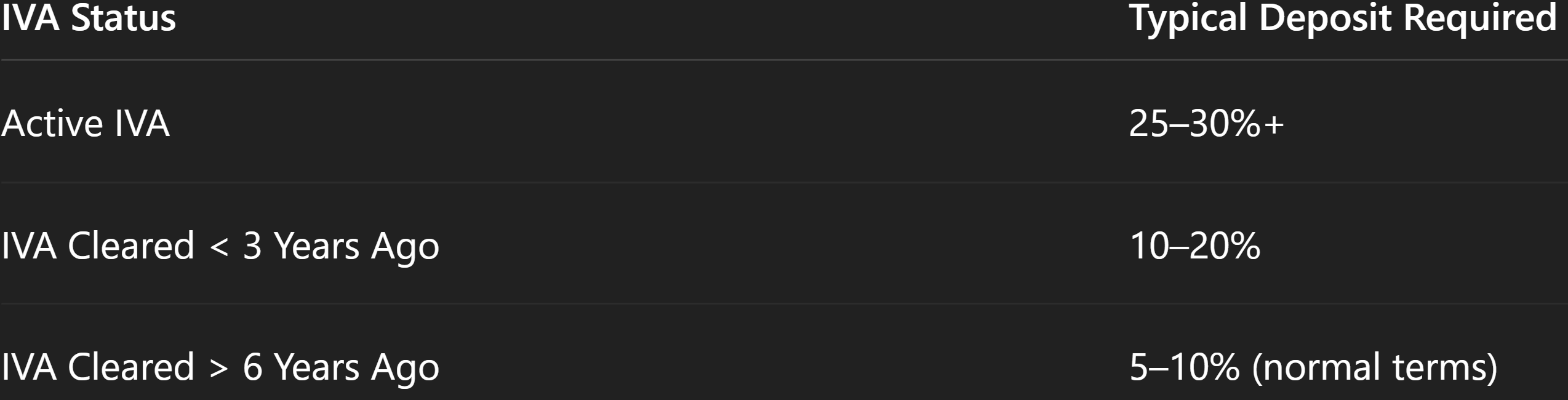

Yes – deposit size matters more when an IVA is involved.

The bigger the gap since your IVA was cleared, the better the deal you’re likely to get.

Is it still active or fully discharged? The longer it’s been cleared, the better your options.

Lenders will assess whether you can still afford the mortgage payments, especially if you're still repaying debts under an IVA.

They’ll check payment history, defaults, and whether you've been rebuilding credit.

Lenders reduce their risk by requiring a higher deposit. LTV caps may be lower for applicants with an IVA.

This is sometimes possible – but it’s not always the best move.

Speak to a broker to run both scenarios before deciding.

Yes, but you’ll likely need a bigger deposit and a specialist lender. Expect the lender to base their decision on the person with the IVA.

Yes. Always be transparent. Lenders will find it in credit checks, even if it’s off your file.

Yes, but only with certain lenders – and only if the IVA is cleared before completion. We can help you check the latest scheme rules.

Absolutely. Once you pass the 3- or 6-year mark, many high-street lenders will offer improved rates and lower deposit requirements.

“Most mainstream lenders won’t accept IVA applicants, but the specialist mortgage market in 2025 is far more flexible than it was just a few years ago. With the right prep, approval is absolutely possible.” — Will Sharman, Mortgage Broker

A lot of people try to go it alone or apply with their bank – only to get declined and damage their credit file further. Don’t make that mistake.

Get a free quote or personalised mortgage check today Let’s find out if now’s the right time and if not, we’ll show you exactly what to do to get ready.

Buying a home in London can feel like a minefield, especially with rising prices and different types of mortgages available. In this guide, we’ll break it all down for you in plain English. Whether you’re a first-time buyer, landlord, or remortgaging, we’ll walk you through what you need to know to make informed decisions and move forward with confidence. We’ll also share expert tips from our team at Mortgage Brokers Near Me, who’ve helped thousands of clients secure mortgages across the capital.

Read Article

A mortgage in principle is a quick way to find out how much you could borrow before you start house-hunting. This guide explains what it is, why it matters, and how to get one. It’s based on current UK mortgage processes and applies to first-time buyers and home movers.

Read Article

A clear, beginner-friendly guide to the five main types of buy-to-let investments – Airbnb, HMO, AST, social housing, and student lets – with pros, cons, example costs, and tips to help you choose. Learn what each option involves and when to speak to a mortgage expert for tailored advice.

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.