Is Using a Mortgage Broker Worth It? A Complete Guide for Homebuyers in Essex

Mar 18, 2025

Buying a home or remortgaging can be overwhelming, especially with so many mortgage options available. If you’re wondering “Is it cheaper to use a mortgage broker?” or “Should I get a mortgage broker or do it myself?”, this guide will help you make an informed decision.

At Mortgage Brokers Near Me, we provide expert mortgage advice across Essex, helping buyers secure the best mortgage deals. In this guide, we’ll answer:

✅ How much does the average mortgage broker cost?

✅ Can I get a mortgage 7 times my salary?

✅ Can I speak to a mortgage advisor for free?

✅ What mortgage can I get on a £45K salary?

✅ How to get the lowest mortgage rate?

Let’s dive in.

A mortgage broker is a specialist who finds and secures the best mortgage for your situation. Unlike banks, which only offer their own products, brokers search the whole market to find deals that suit your needs.

Here’s how a mortgage broker can help:

Comparing Mortgage Rates – Accessing thousands of deals from multiple lenders.

Handling the Application Process – Managing paperwork and reducing stress.

Providing Expert Advice – Guiding you through affordability checks and lender requirements.

Saving You Money – Brokers often have access to exclusive rates lower than those found directly at banks.

Many homebuyers assume going directly to a bank is the most cost-effective option, but mortgage brokers can actually save you money in the long run. Here’s why:

✅ Lower Interest Rates – Brokers can find exclusive rates that banks don’t offer directly.

✅ Whole-Market Access – Instead of being limited to one lender, brokers compare multiple lenders to find the best deal.

✅ No Hidden Fees – Some mortgage brokers, including Mortgage Brokers Near Me, offer free mortgage advice.

💡 Tip: Some brokers charge fees, while others get paid through lender commissions—meaning their service is free for you.

“A good mortgage broker doesn’t just find you a deal — they save you hours of paperwork, weeks of waiting, and thousands over the term.”

The cost of a mortgage broker varies depending on experience, complexity, and lender commissions.

Fixed Fee: £300 – £600

Percentage Fee: 0.3% – 1% of the mortgage amount

Free Brokers: Some brokers earn a commission from lenders, meaning their service is free for you.

At Mortgage Brokers Near Me, we provide free mortgage advice, so you don’t pay any upfront costs.

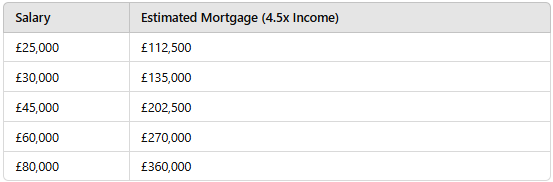

Most lenders in the UK cap mortgages at 4 to 4.5 times your salary, but in some cases, you may be able to borrow 5 to 7 times your income.

High Earners – Those earning £100K+ may qualify for higher salary multiples.

Professionals – Doctors, lawyers, accountants, and certain professionals may access enhanced income multiples.

High Deposit Holders – A larger deposit may increase the loan multiple you’re offered.

A mortgage broker can help assess your eligibility and find lenders offering higher income multiples.

Yes! Many mortgage brokers, including Mortgage Brokers Near Me, offer free initial consultations. Speaking to a mortgage broker gives you:

✅ Personalized mortgage advice

✅ Access to the best rates

✅ A clear understanding of your borrowing power

It’s worth booking a free consultation to explore your mortgage options without any obligation.

To secure the best mortgage rate, follow these steps:

Improve Your Credit Score – A higher score unlocks better interest rates.

Increase Your Deposit – The bigger your deposit, the lower your interest rate.

Compare Lenders – Brokers can access exclusive deals you won’t find at banks.

Fix Your Financial Profile – Reduce debts and avoid unnecessary expenses before applying.

Consider a Fixed-Rate Mortgage – Locks in a low rate for 2 to 5 years, protecting against rate rises.

💡 Working with a mortgage broker ensures you find the lowest available rate based on your financial situa

NatWest offers fixed-rate and variable-rate mortgages, with rates depending on:

Loan-to-Value (LTV) – The more you borrow relative to the property value, the higher the interest rate.

Market Conditions – Mortgage rates fluctuate based on Bank of England interest rates.

Credit Score & Financial History – Higher scores get lower rates.

To find out today’s mortgage rates, speak to a broker who can compare NatWest rates vs. other lenders to get the best deal.

🔹 Average Broker Fee: £300 - £600

🔹 Percentage-Based Fee: 0.3% - 1% of the mortgage amount

🔹 Free Mortgage Brokers: Some brokers are paid by lenders, meaning their service is free for you.

At Mortgage Brokers Near Me, we offer free mortgage advice, so you don’t pay a penny for expert help.

Your mortgage affordability depends on factors like deposit size, credit score, and financial commitments.

💡 Tip: If you have a large deposit or minimal debt, some lenders may offer higher multiples.

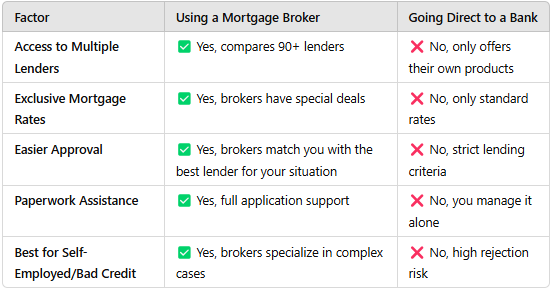

If you’re wondering whether to go it alone or work with a broker, here’s a comparison blow

Working with a mortgage broker in Essex gives you the best chance of securing a lower mortgage rate, better approval odds, and expert guidance.

“Comparison sites show you options. Mortgage brokers show you what’s right for you — based on your goals, not just the rates.”

If you’re looking for the best mortgage rates, expert advice, and a hassle-free process, using a mortgage broker in Essex is the smartest choice.

✔ Find the lowest interest rates

✔ Compare mortgages from 90+ lenders

✔ Get free, expert mortgage advice

✔ Increase your chances of approval

📞 Get in touch today and start your mortgage journey with confidence!

The best life insurance isn’t about the cheapest premium or a brand name. It’s about cover that’s set up correctly, pays out when needed, and fits your financial situation. At Mortgage Brokers Near Me, we make sure policies are structured from the start so your family or business is properly protected when it matters most.

Read Article

A mortgage deposit is the amount you contribute toward a property purchase before a lender provides the rest. In the UK, deposits usually start from 5%, but the amount you need, where it can come from, and how it must be proven depends on your situation, the lender, and the property type. This guide explains mortgage deposits in plain English, including gifted deposits, proof of funds, common mistakes, and how deposits affect mortgage rates.

Read Article

Ground rents are being capped at £250 a year, but the change is not immediate and it does not automatically fix mortgage issues for leaseholders. This guide explains what ground rent is, what the new cap actually means, when it comes into force, and how lenders assess leasehold properties today. Written to help buyers and existing leaseholders avoid costly mistakes when selling, buying, or remortgaging a leasehold home.

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.