Is It Worth Going Through a Mortgage Broker? A Complete Guide for Homebuyers in Reading

Mar 18, 2025

Buying a home or refinancing a mortgage is one of the biggest financial decisions you’ll make. If you're wondering, “Is it worth going through a mortgage broker?”, you're not alone. Many homebuyers debate whether they should go directly to a bank or use a broker to find the best mortgage deal.

At Mortgage Brokers Near Me, we specialize in helping clients across Reading, Bracknell, and Wokingham secure the best mortgage rates while providing expert, impartial advice. This guide will answer:

Let’s break it down.

“A good mortgage broker doesn’t just find you a deal — they save you hours of paperwork, weeks of waiting, and thousands over the term.”

One of the most common concerns about using a mortgage broker is cost. Mortgage broker fees vary based on factors such as experience, the complexity of the case, and the lender's commission structure.

On average, mortgage brokers charge:

Fixed Fee: £300 – £600 for their services.

Percentage-Based Fee: Some charge 0.3% – 1% of the mortgage amount.

Commission-Based: Some brokers receive payment from the lender, meaning their service is free to you.

At Mortgage Brokers Near Me, we offer free mortgage advice with no hidden fees, helping you save money while securing the best deal.

Honesty is key when working with a mortgage broker. However, some statements can harm your mortgage application:

🚫 “I have no debt” – If you have credit cards or loans, be upfront about them. Lenders will see your credit report.

🚫 “I’m planning to change jobs soon” – Lenders prefer stable employment, so switching jobs mid-application can be a red flag.

🚫 “I can afford a higher monthly payment” – Your affordability is based on your income and expenses, not just what you think you can pay.

🚫 “I’m making a big purchase soon” – Avoid large expenses before mortgage approval, as it can impact your credit score and affordability.

Being transparent with your mortgage broker ensures they can find the best lender for your situation.

The best time to speak to a mortgage broker is before you start house hunting. Here’s why:

📍 Before getting a Mortgage-in-Principle – Know how much you can borrow before making an offer.

📍 If you’re self-employed or have a complex income – Get expert advice to avoid rejection.

📍 If you’re remortgaging – Compare deals to save money on your next mortgage term.

📍 If you have bad credit – A broker can help find lenders who accept lower credit scores.

By speaking to a mortgage broker early, you increase your chances of finding the best mortgage deal with minimal stress.

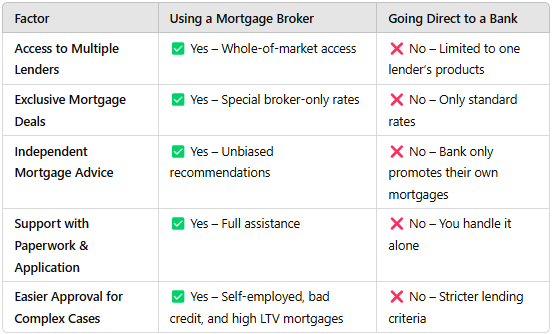

When comparing a mortgage broker to a bank, here’s what you need to consider:

While a bank may work for straightforward applications, a mortgage broker provides access to better rates, increased approval chances, and expert support—making it the smarter choice for most homebuyers.

If you're looking for easy mortgage approval, some banks are more flexible than others. Here are some of the best lenders based on different needs:

For First-Time Buyers: Halifax, Nationwide – They offer low-deposit options and government-backed schemes.

For Self-Employed Applicants: HSBC, Santander – More flexible income assessment for freelancers and contractors.

For Bad Credit: Aldermore, Kensington Mortgages – Specialize in adverse credit and non-traditional income.

For Buy-to-Let: Barclays, The Mortgage Works – Great for rental property investors.

A mortgage broker in Reading can assess your situation and find the lender that best matches your financial profile.

“Comparison sites show you options. Mortgage brokers show you what’s right for you — based on your goals, not just the rates.”

✅ If you want access to the best mortgage rates, a mortgage broker is the way to go.

✅ If you’re self-employed, have bad credit, or need help with complex applications, a broker can match you with the right lender.

✅ If you’re looking to save time and money, a mortgage broker simplifies the entire process.

At Mortgage Brokers Near Me, we compare thousands of mortgage products, ensuring you get the best deal available—completely free.

📞 Ready to find the right mortgage? Speak to an expert today!

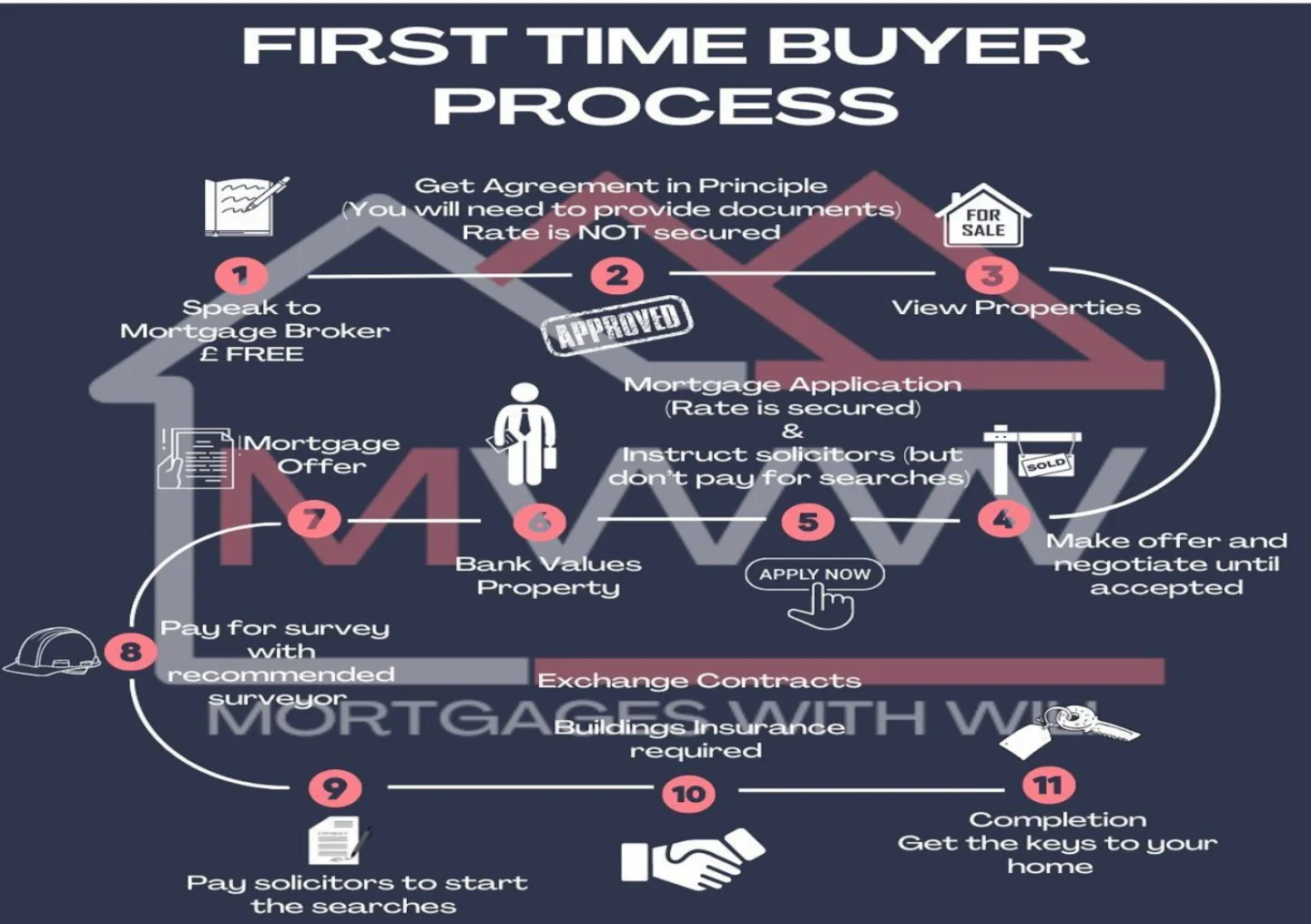

A clear, step-by-step guide to the first-time buyer process, written by Will Sharman of Mortgage Brokers Near Me. Learn what happens at each stage and when to get expert help.

Read Article

If you’re searching online for “find a mortgage broker near me,” you’re not alone and you’re in the right place. Whether you’re buying your first home, refinancing, or investing in property, a mortgage broker can make all the difference. In this guide, we’ll walk you through how to find a trusted mortgage broker in the UK, what to look out for, and how we at Mortgage Brokers Near Me help thousands of people secure the right mortgage deal every year.

Read Article

First-time buyer? This guide covers deposits, stamp duty, mortgage types and hidden costs. Written by Will Sharman of Mortgage Brokers Near Me, it explains the process step-by-step and shows how we can help you buy with confidence.

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.