A mortgage in principle is a quick way to find out how much you could borrow before you start house-hunting. This guide explains what it is, why it matters, and how to get one. It’s based on current UK mortgage processes and applies to first-time buyers and home movers.

Oct 6, 2025

A mortgage in principle (also called an Agreement in Principle or Decision in Principle) is a statement from a lender showing how much they might be willing to lend you.

It isn’t a full mortgage offer, but it’s a useful starting point when you’re figuring out your budget. Estate agents also take buyers more seriously when they already have a mortgage in principle.

Getting a mortgage in principle early in your search has clear benefits:

Before you get a mortgage in principle, make sure you’ve gathered some basic information:

Lenders use this information to run a soft credit check and estimate how much they may lend.

You’ve got three main ways to do it:

Most banks and building societies let you apply online in under 15 minutes. You’ll get a figure showing the maximum they may lend, subject to checks later.

A broker like MBNM can check your situation against multiple lenders at once. This is especially useful if your income isn’t straightforward or you want to avoid unnecessary credit checks.

Your current bank might offer a mortgage in principle quickly since they already hold your financial data. It’s often fast, but you may not get the best deal if you only look there.

Once you have your mortgage in principle, you can:

Just remember, a mortgage in principle isn’t binding. The lender will do full checks when you apply for the actual mortgage.

Most mortgage in principle certificates are valid for 30 to 90 days. If yours expires before you find a property, you can usually renew it easily with updated details.

If your financial situation changes in the meantime (e.g. new job, more debt), the amount offered may change too.

At Mortgage Brokers Near Me (MBNM), we help buyers secure mortgage in principles quickly and with minimal fuss. Our team looks at your situation, matches you with suitable lenders, and guides you through what to expect next.

Whether you’re buying your first home or moving up the ladder, we’ll help you set a clear budget and move confidently. Get in touch with us here.

.webp)

Tenure explains how you legally own a property. Freehold means you own the building and the land outright. Leasehold means you own the property for a fixed period but not the land. The difference affects mortgage eligibility, resale value and long-term costs. If you are buying or remortgaging, tenure is not just legal jargon. Lenders care about it. A short lease, ground rent clauses or restrictive terms can limit which lenders will consider your application. This guide explains what tenure means in plain English and how it affects your mortgage.

Read Article

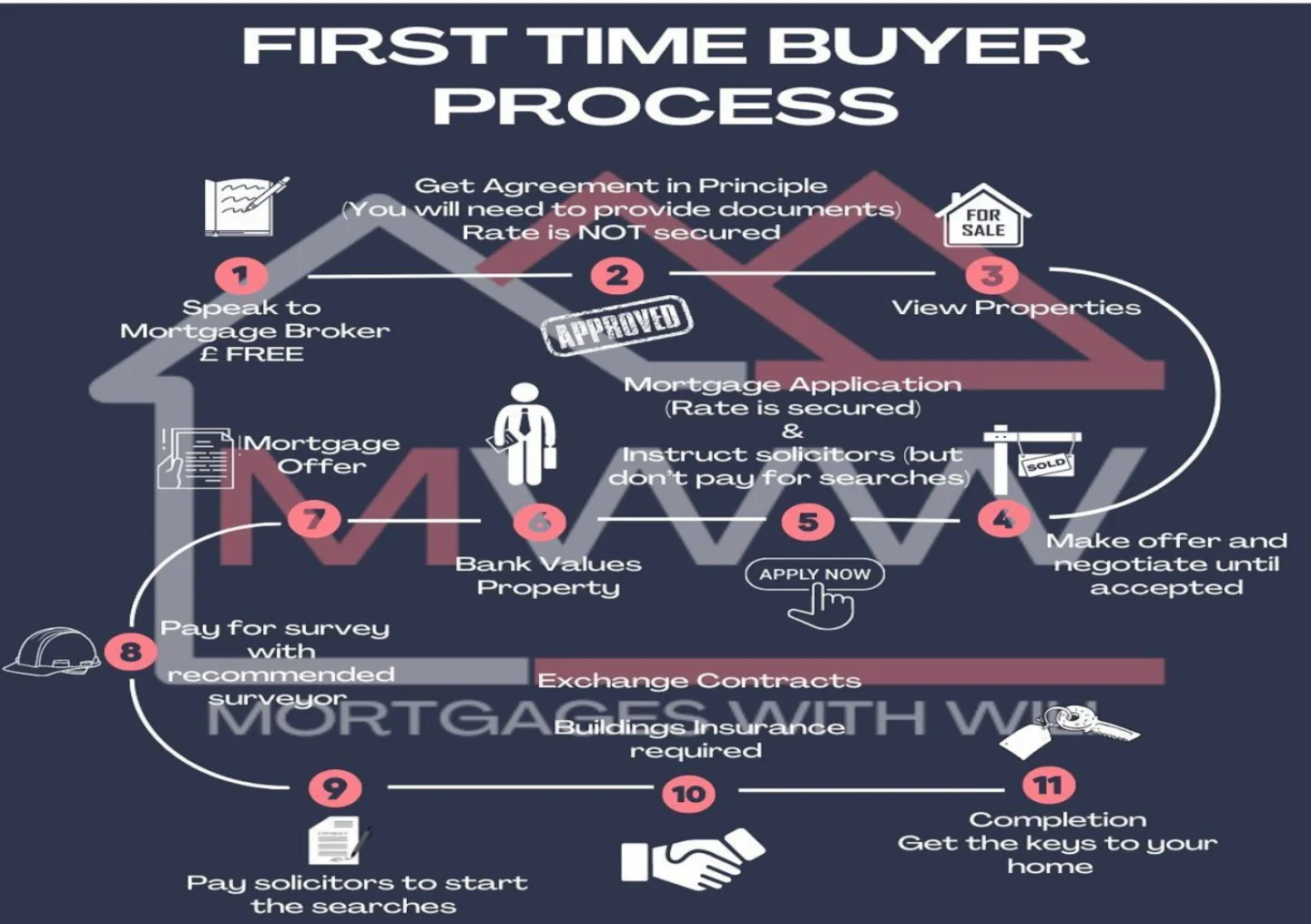

A clear, step-by-step guide to the first-time buyer process, written by Will Sharman of Mortgage Brokers Near Me. Learn what happens at each stage and when to get expert help.

Read Article

Being on a zero-hour contract doesn’t automatically rule you out of getting a mortgage. While lenders see variable income as higher risk, many will still lend if you can show consistency, a solid work history, and reliable earnings. This guide explains how zero-hour contract mortgages work, how income is assessed, what deposit you might need, and how Mortgage Brokers Near Me help applicants avoid rejections and secure the right lender first time.

Read ArticleIf you’re buying, moving, or remortgaging, speak with a MBNM adviser and get clear guidance on what’s realistically available to you, before you commit to anything.